.

Combating Counterfeit Currency in Delhi: Strengthening Financial Security

counterfeit currency in delhi , the bustling capital city of India, renowned for its historical landmarks, cultural diversity, and economic significance, confronts the persistent challenge of counterfeit currency. Despite efforts to fortify security measures and promote digital transactions, counterfeiters persist in producing fake banknotes, posing risks to businesses, individuals, and the integrity of the financial system. This article delves into the issue of counterfeit currency in Delhi and proposes strategies to combat this illicit activity.

The Risks of Counterfeit Currency:

Counterfeit currency presents significant risks to Delhi’s financial stability and reputation. Fake banknotes can circulate undetected, resulting in financial losses for businesses and individuals who unknowingly accept them. Moreover, the proliferation of counterfeit currency undermines trust in the Indian rupee, the national currency, potentially causing economic instability and damaging the credibility of financial institutions.

Detection Challenges:

Detecting counterfeit currency poses substantial challenges as counterfeiters continuously refine their methods to evade detection. In Delhi, where cash transactions remain prevalent, especially in informal sectors, individuals and businesses must remain vigilant to avoid falling victim to counterfeit currency scams. Limited awareness and insufficient counterfeit detection tools exacerbate the community’s vulnerability to financial losses.

Safeguards and Prevention Measures:

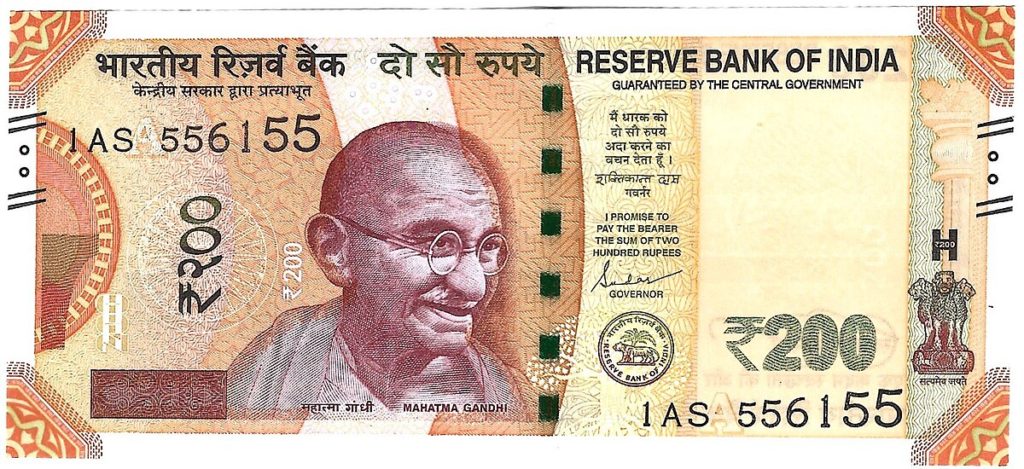

To counter the threat of counterfeit currency, implements various safeguards and prevention measures. The Reserve Bank of India (RBI), the central banking institution, regularly updates security features. Indian rupee banknotes, including intricate designs, watermarks, security threads, and color-shifting inks, making it difficult for counterfeiters to replicate.

Additionally, public awareness campaigns play a crucial role in educating individuals about the security features of Indian currency and promoting the use of digital payment methods. Financial institutions and businesses are encouraged to invest in advanced counterfeit detection technologies and provide training to employees on recognizing counterfeit currency.

Collaborative Efforts:

Addressing counterfeit currency requires collaboration among government agencies, law enforcement, financial institutions, and the public. In Delhi, organizations such as the Delhi Police. RBI, and other regulatory authorities work collaboratively to investigate counterfeit currency cases, apprehend offenders, and dismantle counterfeit currency networks. Public participation is crucial, with citizens encouraged to report suspicious banknotes to the authorities.

Conclusion:

Counterfeit currency poses a significant threat to Delhi’s financial integrity and public trust. By implementing robust detection measures, raising awareness, and fostering collaboration between stakeholders. Delhi can mitigate the risks associated with counterfeit currency and uphold the integrity of its financial transactions. Continued vigilance, innovation in security features, and proactive enforcement efforts are essential to combat this illicit activity. Preserve Delhi’s reputation as a secure and prosperous capital city.